Automotive Central Switches: The Latest Step in the Evolution of Cars

When you hear people refer to cars as “data centers on wheels,” they’re usually thinking about how an individual experiences enhanced digital capabilities in a car, such as streaming media on-demand or new software-defined services for enhancing the driving experience.

But there’s an important implication lurking behind the statement. For cars to take on tasks that require data center-like versatility, they need to be built like data centers. Automakers in conjunction with hardware makers and software developers are going to have to develop a portfolio of highly specialized technologies that work together, based around similar architectural concepts, to deliver the capabilities needed for the software-defined vehicle while at the same time keeping power and cost to a minimum. It’s not an easy balancing act.

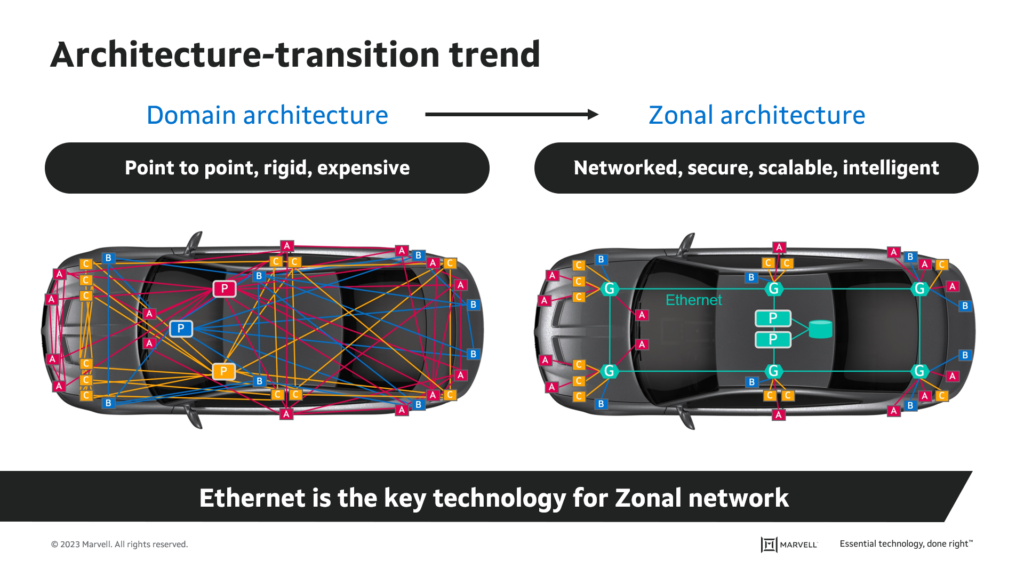

Which brings us to the emergence of a new category of products for the zonal architecture, specifically zonal and the associated automotive central Ethernet switches. Today’s car networks are built around domain localized networks: speakers, video screens and other infotainment devices link to the infotainment ECU, while powertrain and brakes are part of the body domain, and ADAS domain is based on the sensors and high-performance processors. Bandwidth and security can be form-fitted to the application.

Domain architecture, however, has a multitude of problems. First, it makes sharing data between domains more difficult. What if surrounding cameras are on the infotainment network and need to transfer data to the ADAS network? Or if the manufacturer wants to introduce a predictive maintenance service that requires data from the engine to an external 5G link? Unnecessary complexity and degradation in performance is the result.

Domains also mean excess cables, many running the length of the car. Some mid-sized economy cars have 1.5 kilometers of electrical, networking and other cables. They fit within voids and tight spaces and often have to be inserted by hand at the factory. This can add both manufacturing and maintenance costs. Plus, if it’s an EV, extra weight equals lower range.

In the (Auto) Zone

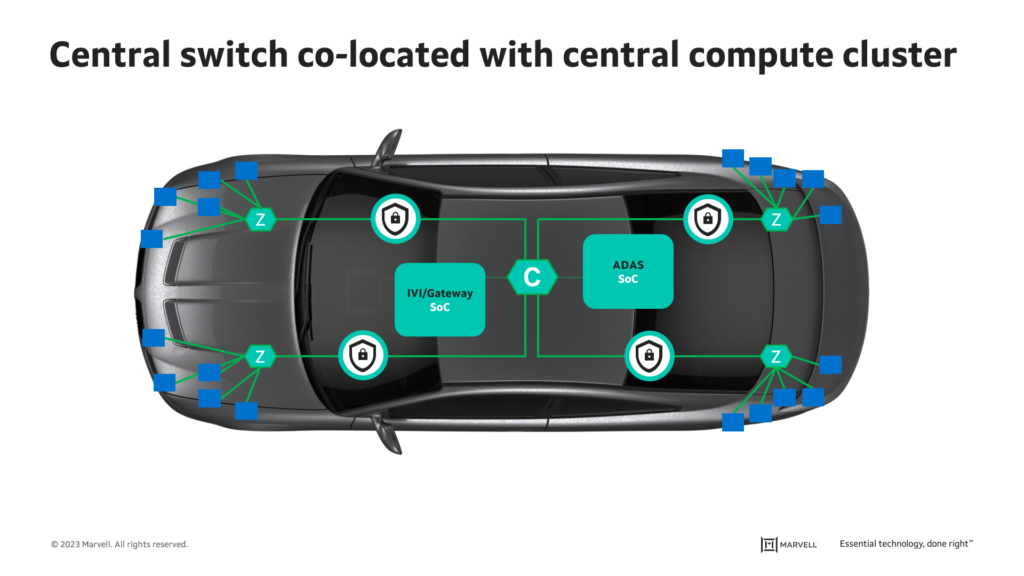

Enter zonal architectures. In zonal architectures, all of the devices in a particular physical zone of a vehicle are linked to a local zonal aggregation switch, using very short cables. These zonal aggregation switches—and there will be four to six zones in cars by the second half of the decade—then link up to central switches that coordinate and organize traffic flow between the zones, central computing and storage, and external services.

Recently, we debuted a new family of central Automotive Ethernet switches. With the industry’s highest capacities at 90 Gbps and 60 Gbps and advanced security features, the new Brightlane™ MV-622x family is tailored to be able to manage traffic across different zones.

If this looks familiar, it should. It’s similar to the architectures in enterprises with zonal switches playing the role of enterprise edge switches and centralized switches serving as aggregation switches. The concept is also catching on. The number of Ethernet ports shipped annually to the automotive industry will likely pass 1 billion in 2025 or 2026, more than double today’s rate and 10x the number shipped in 20181.

The benefits to building cars like data centers are also massive:

- Better, more versatile compute architectures for new services. In the olden days (i.e. 15 years ago), manufacturers bragged about having 70 or 100 processors in a car1. Unfortunately, most of them were fixed-function microcontrollers. With zonal architectures, car makers are replacing them with more powerful, programmable centralized processors capable of performing far more tasks: running complex software, leveraging AI for diagnostics, creating containers for different apps. By the virtue of sharing TOPS and FLOPS, everything gets a lift in performance.

- Cameras, Cameras, Cameras. The number of visual technologies in cars will spike dramatically in the coming years. Not only will we see an increase in the number of cameras across more cars, we will also see advanced technologies like LiDAR and thermal cameras2 become more commonplace. These applications, however, generate massive amounts of data that need to be analyzed in real time. Last year, Marvell released a camera bridge to bring visual data into the system. Expect more innovation in this space.

- Better storage utilization. Instead of stashing a small amount of flash at every controller, GBs of storage can be aggregated and located next to the central processors, or directly on the zonal backbone, and provide access to every processor and ECU in the vehicle.

- Better security. Infotainment devices get the same level of security as brakes. And security can be enhanced between the zonal and central levels. The increased bandwidth would also open the door to new services. Imagine a hybrid cloud service that looked for malware attacks by analyzing things like network temperature or data flow3. With the data bandwidth supplied by a tiered architecture, something like this becomes possible.

- Less cable. With zones, devices are at most a few feet away. Full-length car cable runs to connect an actuator or sensors to a hub are gone. That means lower weight, cost and manufacturing headaches.

- More rapid innovation. Ethernet was invented 50 years ago4 and, like hard drives, has outwitted the many predictions of its demise. It remains the mainstay of the technology industry for networking and thousands of engineers work worldwide to advance it. Automotive benefits from this.

All of this, of course, is only possible if a robust network exists in the first place to tie everything together.

Automotive Technology and Darwin’s Finches

But is automotive central Ethernet switching a full-fledged product category? Right now, the main difference is bandwidth capacity and some security features. Over time, though, you’ll see different feature sets that will further distinguish zonal and central switches. Again, look to history: cloud switches are one of the fastest-growing segments in infrastructure networking, but they grew out of enterprise switches. Similarly, today’s AI switches are just cloud switches with a different SKU: over time, they will evolve into distinct species.

Automotive architectures, however, will evolve differently than those for data centers: the “on wheels” part of the equation changes what OEMs will need from digital technology. The real-time performance demand of applications like ADAS might require car makers to balance AI processing between the zones and the central compute cluster instead of shifting it all to a centralized system. On the other hand, single (or dual) centralized compute systems might be more cost effective and we expect the market to evolve in this direction over time. The same goes for storage and security. For storage, the growing capacity will push many OEMs to centralized storage that can serve all domains in the vehicle. For security, the increase of SDV and connected cars means we can expect laws that will demand new security protocols.

We can see where the road is headed, and Marvell is ready to help auto makers bring their wish list to life.

1. Marvell estimates (Ethernet port units, growth) and TechInsights (Automotive Infotainment and Telematics Systems, 2022).

3. Arm Blueprint and IEEE

4. Wikipedia.

This blog contains forward-looking statements within the meaning of the federal securities laws that involve risks and uncertainties. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future events or achievements. Actual events or results may differ materially from those contemplated in this blog. Forward-looking statements are only predictions and are subject to risks, uncertainties and assumptions that are difficult to predict, including those described in the “Risk Factors” section of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed by us from time to time with the SEC. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and no person assumes any obligation to update or revise any such forward-looking statements, whether as a result of new information, future events or otherwise.